Lucidly's DeFi Curation Breakthrough

Feb 10, 2026

At Lucidly, we're not building just a yield aggregator, we're building a full-stack capital deployment engine. syAssets are built using our stack to show that it's possible to build structured products at scale and soon we'll productise it for everyone to use.

The future of onchain asset management is modular, precision-driven and agentic. we'll make it verifiable and commoditise it. anyone would be able to plug in custom algorithms, agents and much more while still being fully non-custodial.

Benefits for DeFi Curators Using the Lucidly Stack

Deploy capital at size across 100s of strategies across multiple networks using one control point.

Connect DeFi protocols across networks to create complicated strategies and run them on automation.

Automate, emergency reallocation and segregated manager roles for separate risk profiles all built-in at the protocol level.

Build UI equipped with real-time transparent reports about capital allocation, yield vesting schedules and withdrawal queue status.

again, this is v0.1. to showcase how easy it is to create a transaction, verify calldata and send it onchain using this - all verification is done onchain. all strategist roles are segregated.

Role-Based Access & Security in Lucidly Stack: Strategist & Owner Roles

These are relevant roles involved in asset management in the lucidly stack:

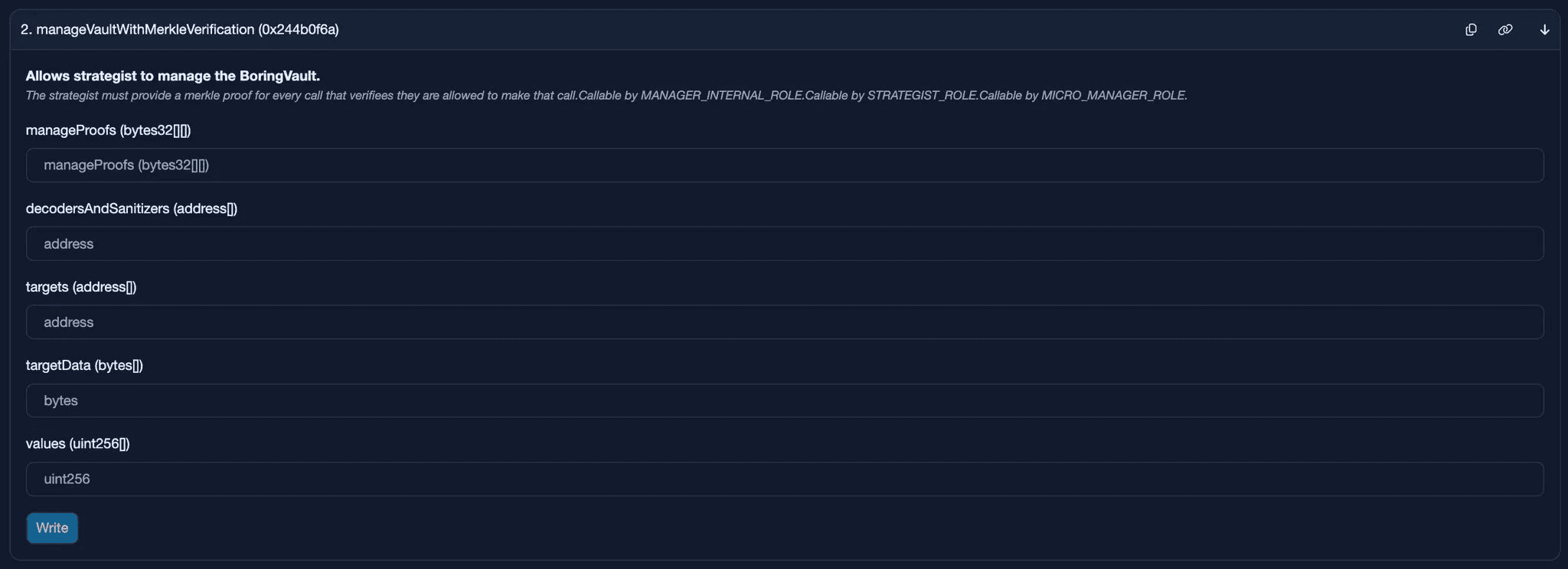

Vault funds can only be operated upon by a address with a STRATEGIST_ROLE. This allows a strategist to call the manageVaultWithMerkleVerification function on the manager smart contract.

Multiple transaction can be bundled together using this format (targets addresses, target data, values) and sent with a merkle proof that the Manager smart contract uses to verify if the caller is an approved strategist for sending the constructed transactions.

Strategy Whitelisting & Onchain Verification in Lucidly Manager

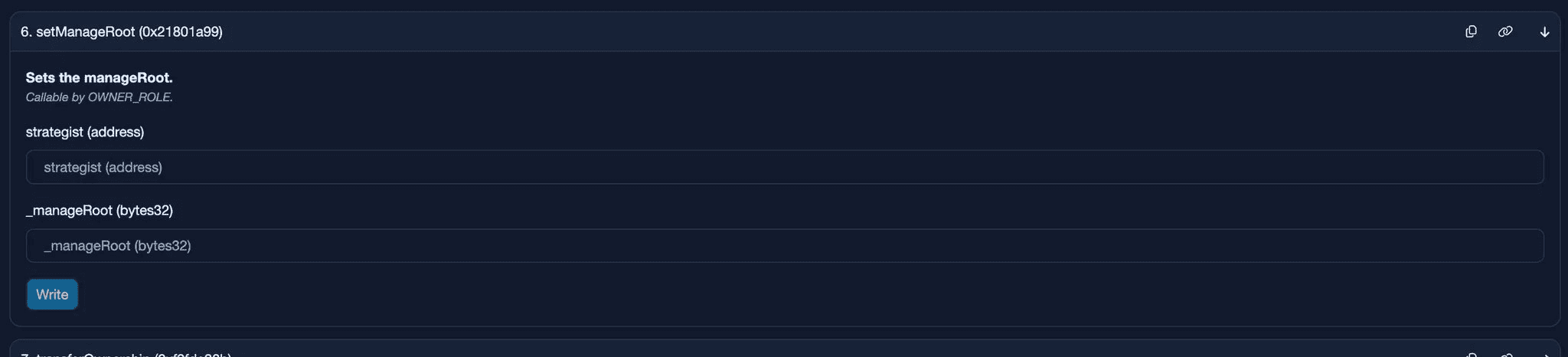

The OWNER_ROLE has the right to assign a set of whitelisted strategies for each strategist address using a manageRoot value.

This value is used to verify transaction calldata every time a strategist manageVaultWithMerkleVerification function-call is triggered.

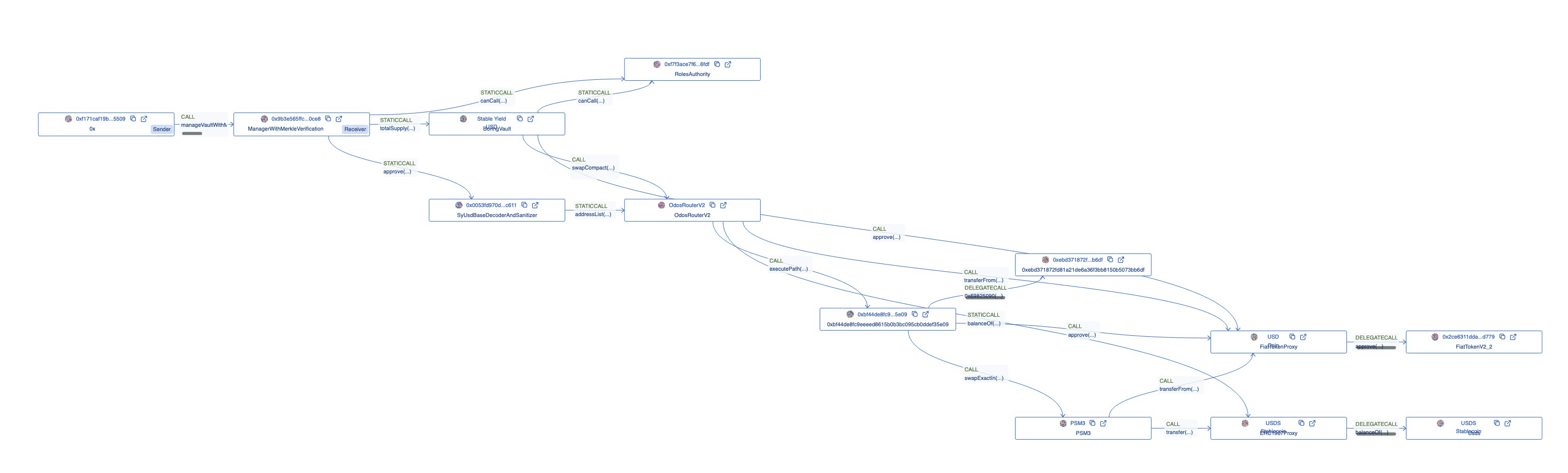

This is an example of a USDC → USDS swap on base network using Odos Router V2.

For the strategist to execute this swap the following rules are enforced at in the Manager verification layer

approve Odos Router V2 to spend USDC

allow USDC as a sell asset on Odos Router V2

allow USDS as a buy asset on Odos Router V2

only allow the vault as the recipient address in the Odos swap transaction.

We're actively inviting exotic defi strategy curators to come build on the Lucidly app and create an edge on execution, performance and transparency.

For any questions, feel free to reach out to me at yashish@lucidlylabs.xyz

TG: @bullishbeers

Lucidly AYP exclusive mainnet beta: https://t.me/+30HYMrAteTg0NmNh

Check out our app at: https://app.lucidly.finance/