Treasury Management RFP for Gnosis DAO

Feb 10, 2026

We recently submitted a joint @LucidlyFinance x @MEVCapital proposal for Gnosis DAO Treasury Management Services, as we shape this - we want to actively interact with the @gnosis_ community and $GNO holders to better address any current performance/liquidity concerns and any further support we could offer to the Gnosis Ecosystem.

https://forum.gnosis.io/t/request-for-proposals-treasury-management-services-for-gnosis-dao/11957/33

Here's the detailed proposal and comprehensive services we intend to offer, feel free to DM us/ share your thoughts on the replies:

Overview

MEV Capital and Lucidly Labs Limited submit this proposal collectively as part of Gnosis Dao’s Treasury Management Services.

Our scope of services extensively cover liquidity management, maintenance of pods for separate DeFi clusters, endowment management, delegated committee, governance and voting, transparency dashboards, monitoring systems and strategic Gnosis ecosystem support.

GIP-143 highlights key inefficiencies on transparency, performance and actionable execution. With this proposal, we ensure accountable performance standards, low latency risk infrastructure and strictly performance based compensation with shared liability in case of negligence.

Introduction

MEV Capital is an institutional digital asset manager with key focus on EVM chains activities. Operating since 2020, MEV specializes in market neutral mandates across highly liquid digital assets and battle-tested decentralized protocols.

MEV Capital clients include crypto-native institutions, family offices, HNIs, Investment banks / publicly listed companies and DAOs and crypto treasuries [references available upon request] with >$400M Assets under Management and >1.5B$ peak AUM curated across DeFi vaults for restaking and borrowing activities.

Lucidly Labs Limited is a research and engineering team building hyperstructures and modular tooling for onchain capital deployment since 2023. Upon execution, Lucidly would be responsible for deployment and maintenance of structured pods with onchain verification, DeFi integrations and reporting and risk infrastructure for Gnosis DAO.

Why MEV Capital x Lucidly Labs

Separation of risk underwriting and execution/accounting is important for 3 major reasons:

Operational segregation: Division of roles in devops/accounting related tasks from asset management as 2 teams use separate infrastructures.

Risk segregation: Lucidly’s real time monitoring infrastructure continuously tracks adherence to MEV-defined risk mandates, automatically flagging deviations and enforcing parameterized health checks.

Contagion containment: Lucidly’s independent capital deployment engine encapsulates each strategy or whitelisted allocation within isolated “pods,” ensuring that strategy specific risks remain ring fenced and do not propagate across the treasury.

Proposed Scope of Work

Operational Liquidity Management

Automated low latency CLMM algorithms with block level benchmarking, rebalancing execution and hedging infrastructure for FX (EURe, GBPe, BRLA, BRZ, ZCHF) and strategic pools on GC ensuring deep DEX liquidityLiquidity Uptime >98% Price Impact (100k swaps) <100bps Backtested Data: https://github.com/lucidlylabs/simulations/blob/master/eurc_usdc_backtest_plot_10_spacing.png

Bridge: Maintaining and ensuring liquidity on various chains with balance tracking and making necessary transactions when needed for third party bridging infrastructure. Operating relayers on behalf of Gnosis

Proposals for GNO incentives issuance from a liquidity utilization first approach aligning financials to gnosisDAO treasury. Replace direct incentive issuance to bribes on vote markets where necessary to save costs

GIP execution (within 1 week of approval) and disbursements with counterparty due diligence

Gnosis Circles liquidity support

Endowment Management

Lending cluster to actively manage stablecoin + ETH exposure across low-risk bluechip Aave and Morpho markets with strict guardrails.

Delta neutral yield cluster, Fixed income yield cluster and Liquidity Provisioning yield cluster.

Automated deposits, rebalances, claims and liquidity buffer maintenance across whitelisted strategies without any manual intervention

Risk adjusted alpha research (Stablecoins and ETH yield instruments)

Strategic GNO buybacks depending on Treasury NAV and Gnosis market cap delta via DEXs,Aggregators, CEXs and OTC[Strategic alignment: Gnosis Ltd. holds sole discretion regarding any deployment. We assure no deployment to any protocol misaligned to the Gnosis ecosystem]

Governance and Voting

Active governance participation for governance tokens held by Gnosis DAO as a delegate to achieve best possible gauge emissions on GC, long term asset preservation and upkeeping the interests of all GNO holders.

Proposing intensive data driven actions and new initiatives for deployed assets that strongly align with Gnosis ecosystem

Monthly reports on voting activity and governance thesis for active feedback loops

Transparency and Reporting

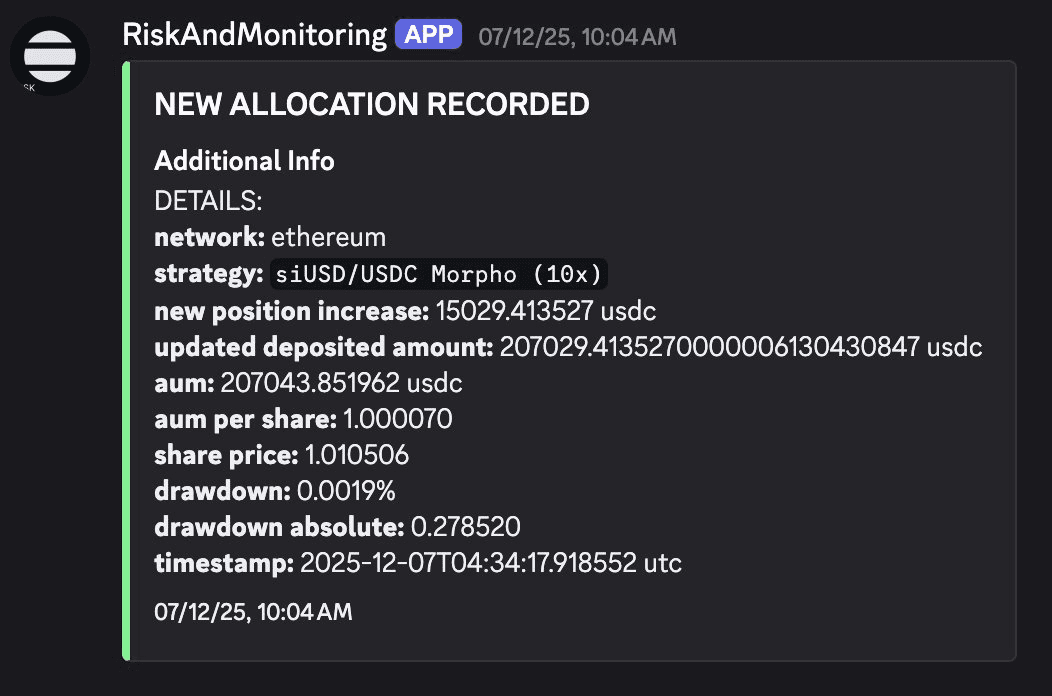

Real-time reporting Dashboard: Offchain infrastructure to - Account attribution from individual yield clusters on multiple timeframes - NAV calculation - Historic rebalances - Treasury deposits and withdrawals - Risk metrics Sample Reporting: https://tinyurl.com/LucidlyDashboards

Onchain verifiability for NAV calculation and allocation record programs by running inside a TEE(Trusted Execution Environment)

Open-sourced API endpoints for data exposed on Treasury Dashboard Sample APIs:

Monthly comprehensive treasury reports covering Portfolio Summary (by asset, chain) Revenue (Historic and Current), average APR PnL since inception - MTD, YTD Active Positions - purpose and deployment of funds across protocols, loans management (Collaterals, Debts, LTV, max LTV) Tracking execution of approved GIP disbursements GNO incentives provided on Gnosis Chain (by protocol and share)

Telegram/Discord monitoring alerts - to report PnL, APY, rebalances

Gnosis Ecosystem Support

Working closely with Gnosis chain dapp’s on engineering, liquidity front

Business development - additional social coverage for gnosisDAO - performance, reporting and transparency.

Inviting strategic DeFi teams to deploy on GC

Improve current and engineer new defi instruments for GNO onchain

Interact with the community for understanding requirements of liquidity on the gnosis network.

Risk Framework

Curating economic security and managing risk parameters is the most important part of our job. Our risk framework extensively covers:

24/7 alerting systems and automated emergency triggers with Hypernative

Inbuilt verification checks for slippage, price oracles before the execution of any transaction

Pre-approved emergency unwind procedures

Any critical vulnerabilities found disclosed immediately to the DAO with comprehensive incident review

On-call team availability as and when required throughout the length of the term in case of any crisis events

Active public ticketing system with assured response time within 6 hours from the management team

Fee Estimates

As part of the Gnosis Treasury Management mandate, we will use Sky Savings Rate (sUSDS) for stablecoins and Lido staking yield (stETH) for ETH exposure as performance benchmarks, and agree to charge a performance fee with these standards set as the hard hurdle rates for respective assets.

Total Annual Cost: $180,000 base fee + 14% performance fee earned on returns above set performance benchmarks.

Long term Alignment to Gnosis DAO: As part of our long term alignment to Gnosis DAO, we propose denomination of 50% of the performance fee in GNO and remainder in USD vested till the maturity of the annual contract.

[Net performance fee calculation measured year-over-year against benchmark assets yield]

This proposal offers an ongoing engagement and set reviews on preferred timeframes with Gnosis Ltd.

Termination of the services would require a 90 day notice, during which we would be liable to unwind existing positions as per the DAO’s requirement. Performance fee would be applicable pro-rata till date of termination.

Team and Legal Structure

MEV Capital Asset Management Ltd. (BVI) is the Licensed entity as an asset manager that would act as the delegated committee for corporate governance holding mandates from Gnosis Ltd., tradFi counterparties.

Since 2020, we have attracted high caliber talent from top academic institutions and proven track record in both traditional finance and the crypto industry globally. The operations and development team is formed from crypto-native, legal and IT experts from financial fields.

Active in DeFi, we have partnered with the best-in-class institutions offering deep expertise in digital assets management and curated vaults - money markets, staking, multi-strategy and fixed yield.

MEV Capital Historic performance Metrics and Current Deployments: https://vaults.mevcapital.com/

Provided upon request: Fund termsheets, Client references, KYC, KYB, audit documentation.

Timelines

Upon execution of the services agreement with the aforementioned terms, we aim to work with set KPIs. As part of the onboarding, we would require 15 days to set up new clusters, risk infrastructure and reporting dashboards.

Within the first 4 weeks of execution, FX pools and bridge liquidity management deployments will be in production, with a full deployment assured in maximum 45 days from execution of the contract.

Thoughts to the community

In this proposal, we tried to highlight the scope of work based on our asset management expertise with a success aligned fee structure and more context on our entity structure, previous track record and operational competence.

We are open to a community call to review the terms of this proposal/share any additional resources to give a better understanding.

Stoked to participate in the discussions ahead, feel free to reply here for any feedback/questions as we structure this collaboratively.

Team MEV Capital and Lucidly Labs