We Built a Hedged CLMM Strategy. It Prints Fees.

Feb 10, 2026

A pivotal moment for @lucidlyfi.

Over the past months, we have been battle testing CLMM yield strategy vaults with block level LTV management, an exotic source of yield that has never been commoditised at scale before. When it comes to yield bearing BTC derivatives, any APR above 4 percent always sounded either unrealistic or inflated with illiquid incentives. On the other hand there are extremely high volume BTC CLMM pools, [eg. WBTC/WETH uni v3 pool Arbitrum], capturing significant fees but missing two key instruments that make them inaccessible for most yield farmers.

First, there are no instruments to hedge in real time so when liquidity moves out of range the onchain hedge breaks and creates unwanted exposure for end users.

Second, there are no instruments to capture maximum pool fees since most liquidity added to these pools sits as manual broad range orders, which dilutes fee share for LPs and worsens pricing for traders.

Our new hedge btceth mm strategy vault finally makes this source of yield accessible for everyone.

How it works

The biggest unlock we bring is low latency automation across three parameters.

LTV drift makes sure the hedge stays fully maintained during high volatility market events with block level rebalancing whenever orders move out of range.

Benchmark drift computes and verifies exposure to underlying assets across uni v3 pool and aave for accurate accounting.

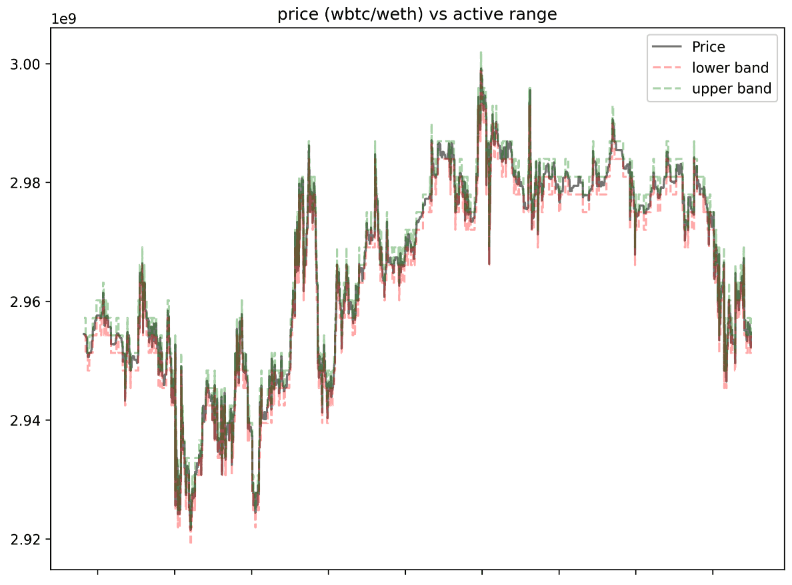

Range drift is the key parameter that creates the prime yield opportunity for end users by verifying the upper tick, lower tick and liquidity for each range order and allocating liquidity into the narrowest tick spacing.

Using these parameters, a liquidity delta is generated and liquidity is rebalanced on every swap into a new range band as price moves. This captures the highest pool fees for the vault while building deeper liquidity around the current asset price ranges.

What this unlocks

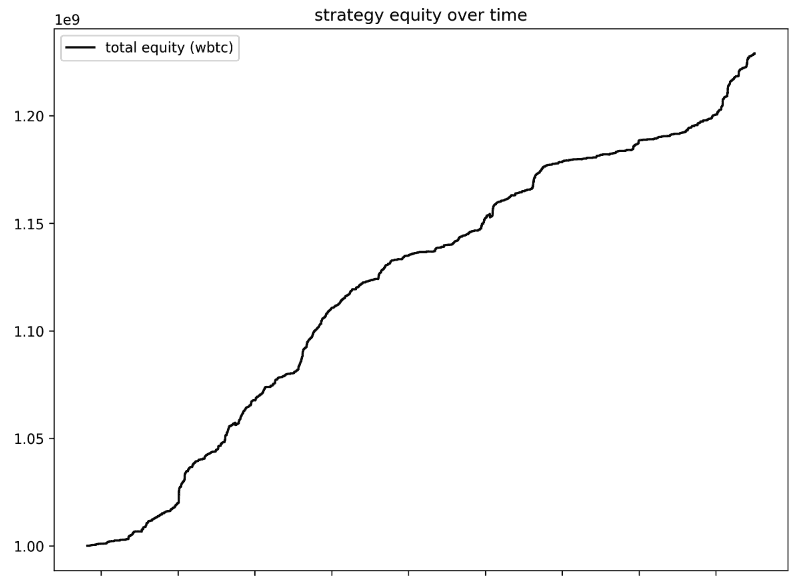

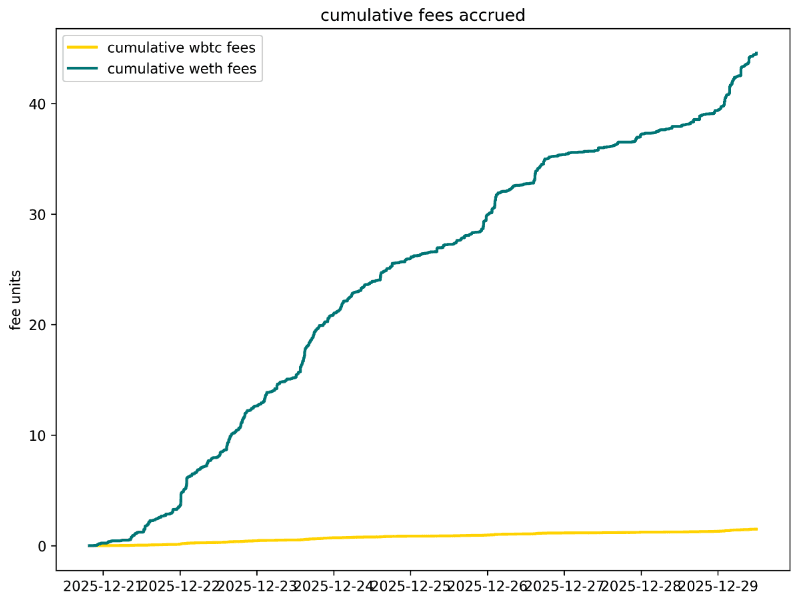

As a mandate for our BTC denominated yield product syBTC, this strategy has been backtested over several months and generated ~23% return on net asset value over a 30 day window. The simulations use a 10 BTC notional size under a perfect zero slippage environment.

This vault offers fee generated from low latency CLMM liquidity provisioning and rebalancing as an exotic source of yield that can consistently clear performance benchmarks. It is an onchain DeFi instrument with minimal risk vectors that touches only two blue chip venues, the Uniswap v3 Arbitrum WBTC WETH pool for fee generation and Aave for the hedge.

The yield logic of this strategy is innovative yet simple. Fee generated on the CLMM pool must exceed slippage or impermanent loss and the cost of borrow required for the hedge.

How to access

The syBTC vault on the Lucidly app executes automated access to the hedge btceth mm strategy. It is entirely verifiable onchain, fully liquid and offers one click deposits in WBTC on Arbitrum for yield denominated directly in BTC.

On the new Lucidly app, you can access hedge market making strategies and a broader range of new yield sources denominated in BTC, ETH and USD. If you are looking for high performance and secure BTC/ETH yield opportunities, Lucidly Labs now unlocks this at scale. No incentives and no inflationary numbers, we let the performance speak.